With Our Unique Buy Before You Sell Program You Will Move In To Your Next Home Up To 2 or 3 Months Sooner*

* this can vary based on the average number of days on market in your area

The current real estate market is making the traditional method of buying your next home (with a home sale contingency) very difficult.

The traditional method of selling a home before buying has been working somewhat satisfactorily for decades.

So, why change?

There have been studies that show that buying, selling, and moving from one home to another have been major contributors to stress, anxiety, and unwelcome compromise.

Most people who are using the old traditional methods have unwittingly become "Contingent HomeBuyers".

First, let's define what is meant by "Contingent HomeBuyer" by examining this very common scenario:

- Your current home has been on the market for a month or two, and you have diligently kept it clean for showings, and have even looked at some possible homes to purchase for your next home.

- Finally, you receive an offer from a buyer to purchase your current home, and are now under contract with a specific closing date 35 to 45 days from now.

- However, many of the homes that you looked at are no longer available, having been already sold while you were waiting for your current home to sell.

- You now have a 35 to 45 day deadline to find another home to buy, get an offer accepted, get your mortgage loan approved, and try to move in before you need to vacate your current home.

- If anything is delayed you will need to find temporary housing and move your furnishings into storage.

- Contractual issues or 3rd party requirements can cause delays during this waiting period.

- Inspections, inspection resolutions, due diligence items, Title issues, or lender delays can all impact the timeline.

- So, if there is any possibility that you are not able to complete the closing on your next home until you have closed on your current home...

- ...You have become a Contingent HomeBuyer.

- Deals can completely fall apart under these circumstances.

I have good news for anyone who wants to sell their home and buy another, but doesn’t want to put up with showings, contingencies, constantly keeping the house clean, temporary living arrangements, storage unit fees, and the uncertainty of not knowing if their next home will be available when they are ready.

Like my old boss used to say, “don’t bring me problems, bring me solutions”.

Buy Before You Sell is the solution.

- Find your ideal next home first, on your schedule, without being rushed by an impending closing date on your current home.

- Eliminate time-crunch induced pressure and stress.

- Enjoy the convenience of not having to put up with showings, keeping the house clean and presentable all the time.

- Forget about needing to declutter and rent a storage unit for all your extra furniture.

- Only move once. You will not need to find temporary housing just because the closing date on your current home may not match with the closing date on your next home.

- Decisions regarding what to move vs what to discard become easier.

- Take care of the minor but necessary repairs after you have moved out, and do it on your schedule.

- Offer your buyer a clean move-in ready home at a premium price.

Schedule a Brief 15 Minute Phone Consultation

So, why change?

The old way is not without a certain amount of stress and compromise.

In spite of the fact that it has been functional for so many years, there are many potential issues with the process.

I'll explain here by giving some actual situations that I have encountered while representing clients when I was a "traditional agent".

Which of these examples is similar to your situation?

"I want to move to a different home, but..."

- Example 1) I’m afraid that if I put my home up for sale and it gets sold, I won’t find another home in time and I might have to rent for a while.

The elapsed time between putting your home up for sale and actually receiving the proceeds so you can buy can sometimes be up to three months. During those 3 months your dream next home can very well be sold to someone else.

"Buy Before You Sell" gives you time to find that desirable home on your schedule without the pressure.

- Example 2) I can’t buy a different house until my current home closes escrow.

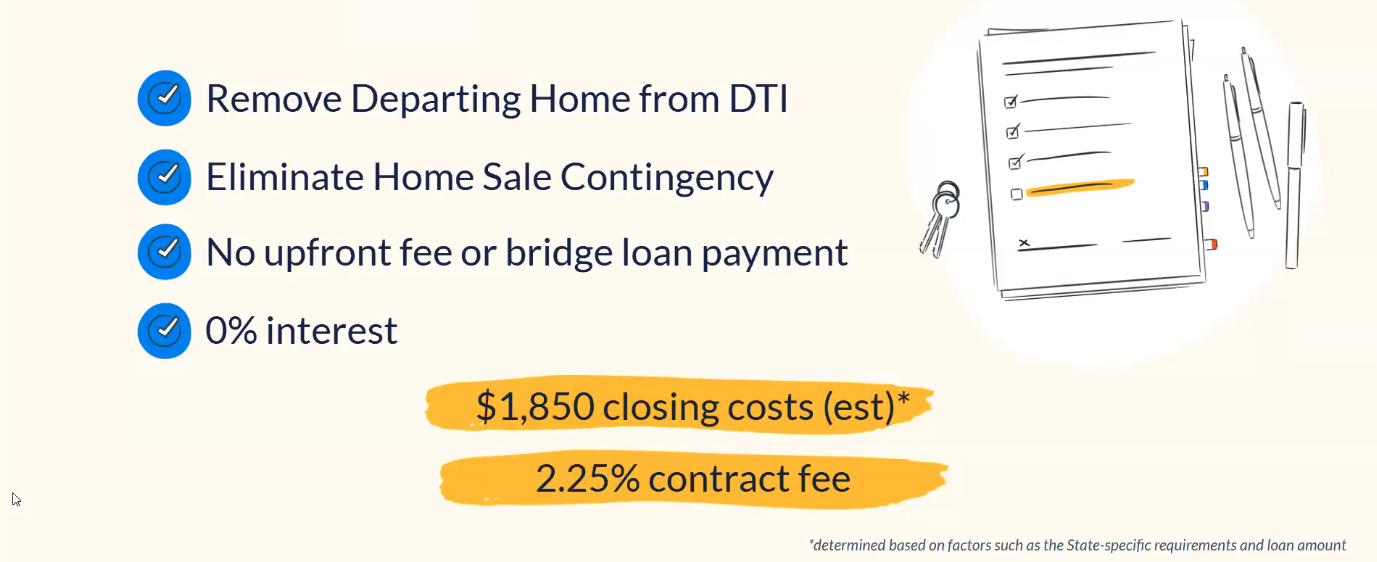

"Buy Before You Sell" provides the funds as a no-interest equity advance to make a guaranteed non-contingent offer on your next home before you have actually sold your current home.

- Example 3) I have an elderly parent (or someone with a disability) living with me, or kids and/or pets, and we can’t readily clean up and leave for every showing.

You will not need to put up with any of the "showing inconveniences" with "Buy Before You Sell". You will have already moved out of your old home and into your new home on your timeline. Once you have moved out we will start preparing your old home for sale so that any showings will take place in a clean unoccupied home, and the prospective buyers can better visualize furniture placement in a clean vacant home.

- Example 4) Each house that I want to buy gets sold before I can get my current home sold.

See example (1) above

- Example 5) I can’t see how I can keep my current home clean and “showing-ready” while it’s for sale. I need to live my life, OR..

-

Example 6) I work from home and can’t stop working to accommodate showings. My dining room table is my office. I would need to put all my papers and files away somewhere and leave the house while some potential buyer is looking through all my stuff and probably won’t buy anyway because the house is a mess.

You will not need to put up with any of the "showing inconveniences" with "Buy Before You Sell". You will have already moved out of your current home and into your next home on your timeline. Once you have moved out we will start preparing your old home for sale so that any showings will take place in a clean unoccupied home, and the prospective buyers can better visualize furniture placement in a clean vacant home.

- Example 7) My home needs some fixing-up before I can put it on the market, and I just don’t have the time or energy to do it.

"Buy Before You Sell" gives you the opportunity to make any necessary repairs or upgrades AFTER you have moved out of your old home. Additionally, we have partnerships with contractors who can take on the work so that you don't need to do it on your own. Some of the proceeds from the equity advance can be set aside for repairs, upgrades, or other preparations.

- Example 8) I’ve tried selling it before, but the seller of the house that I want will not accept an offer that is contingent on the sale of my current home, so I just gave up and stopped trying."

The "Buy Before You Sell" equity advance is not just a bridge loan to get to your next home. It is just one part of the overall package which also includes a guaranteed buyout of your current home. Both aspects combined allow you to make a non-contingent offer for your next home, meaning that the purchase of your next home is not contingent on the sale of your current home. This strengthens the offer in the Seller's eyes because the offer cannot be rescinded if the current home does not sell.

How does the Buy Before You Sell solution compare cost-wise?

The cost of our Buy Before You Sell is going to be roughly the same as doing it the traditional way, and could be quite a bit less when you factor out the extra costs that you will not need such as storage unit, temporary housing, and other extras that are eliminated by our system.

And, your current mortgage payment will not be included in the Debt to Income (DTI) calculation for your next home.

There are other intangibles to consider:

- What is the value to you to be able to move in to your next home 3 months sooner than doing it the old way?

- What is the value to you for using a system that is practically stress-free?

Schedule a no-obligation meeting, either in-person or by phone to discuss how this can help your situation.

Schedule a Brief 15 Minute Phone Consultation

Let's Compare The Typical Step-by-Step Process For Each Method:

Traditional Sell Before You Buy

(14 major steps)

Our Buy Before Sell System

(10 major steps but you are in your next home up to 3 months sooner)

Schedule a no-obligation meeting, either in-person or by phone to discuss how this can help your situation.

Schedule a Brief 15 Minute Phone Consultation

Or fill out this short contact form if you have any general questions or requests about the service.

We will try our best to respond back to you within 24 hours, but usually much sooner.

Phone (call or text)

720.277.9001

Jerry Downer